Healthcare Brew is here to keep you in the loop on all things healthcare, from pharmaceutical advancements to health startups and the latest tech trends that impact hospitals and providers. Moderna recently faced a setback in their earnings projections during their Q2 earnings call, causing concern among investors.

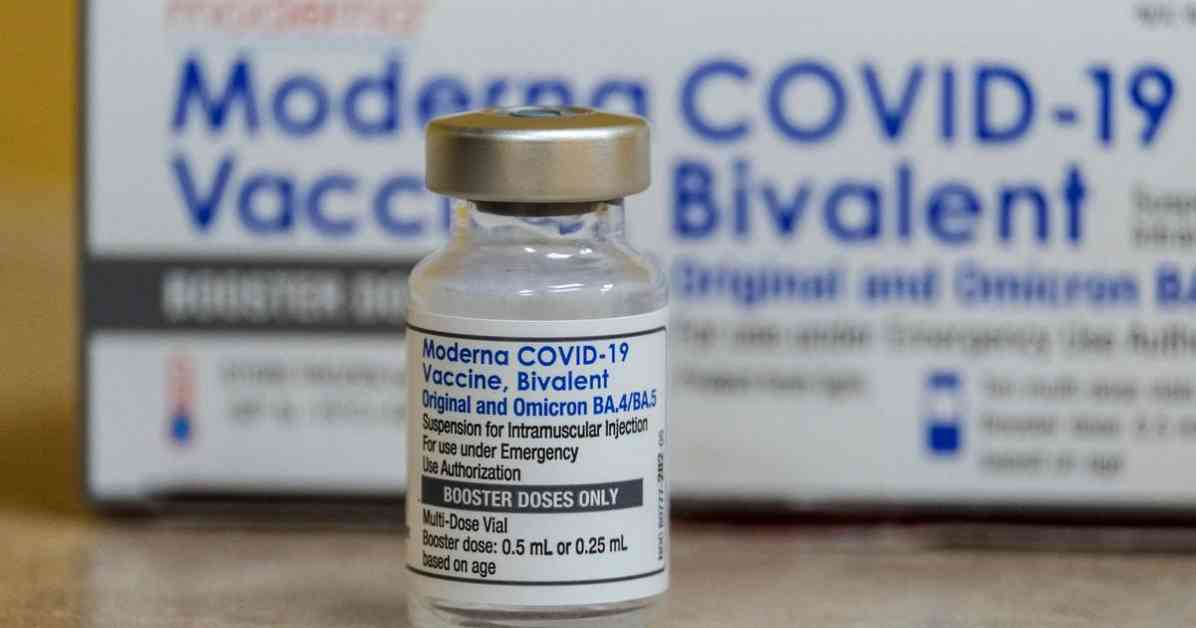

The company had initially projected net sales for the year to be around $4 billion, but they have now revised that estimate to fall between $3 billion and $3.5 billion. This decline is partly due to a decrease in interest in the Covid-19 vaccine, as mentioned by Moderna’s CFO Jamey Mock during the call.

Mock highlighted factors such as lower uptake of their respiratory syncytial virus (RSV) vaccine, decreased European sales of their Covid-19 vaccine, and a low Covid vaccine rate in the US compared to last season. Only about 21% of adults had received the updated booster shot, according to CDC data.

In terms of revenue, Moderna reported $241 million this quarter, down from $344 million in Q2 of 2023. Sales of Spikevax, their Covid vaccine, saw a 37% year-over-year decrease to $184 million. This drop was attributed to the company’s transition into the seasonal vaccine market.

Despite these challenges, Moderna has developed an updated Covid vaccine for 2024-25, which has received regulatory approval in the US and will be launched alongside vaccines from Pfizer and Novavax in the upcoming fall. The CDC recommends the updated shot for everyone six months and older, but booster vaccine rates remain low despite an increase in hospitalizations.

Moderna also received FDA approval for a new RSV vaccine on May 31, but they faced tough competition from Pfizer and GSK, who had already released RSV shots the previous year. Moderna’s CEO, Stéphane Bancel, acknowledged the challenges posed by larger competitors with diverse product portfolios.

On the other hand, Pfizer, Moderna’s main competitor in the Covid vaccine market, reported a decrease in Covid product sales this week. However, the company raised its annual sales projection due to the success of other products like Vyndaqel, a rare heart disease drug.

Pfizer also secured a contract with EU countries to supply large quantities of its Covid vaccine until 2026, potentially overshadowing Moderna’s presence in the region. Despite having promising products in their pipeline, including a dual Covid and flu vaccine and an oncology therapeutic, Moderna faces an uphill battle to boost sales for their Covid and RSV products.

It’s clear that Moderna is facing stiff competition and challenges in the vaccine market, but with ongoing efforts and new product developments, they are determined to navigate these obstacles and emerge stronger in the future.