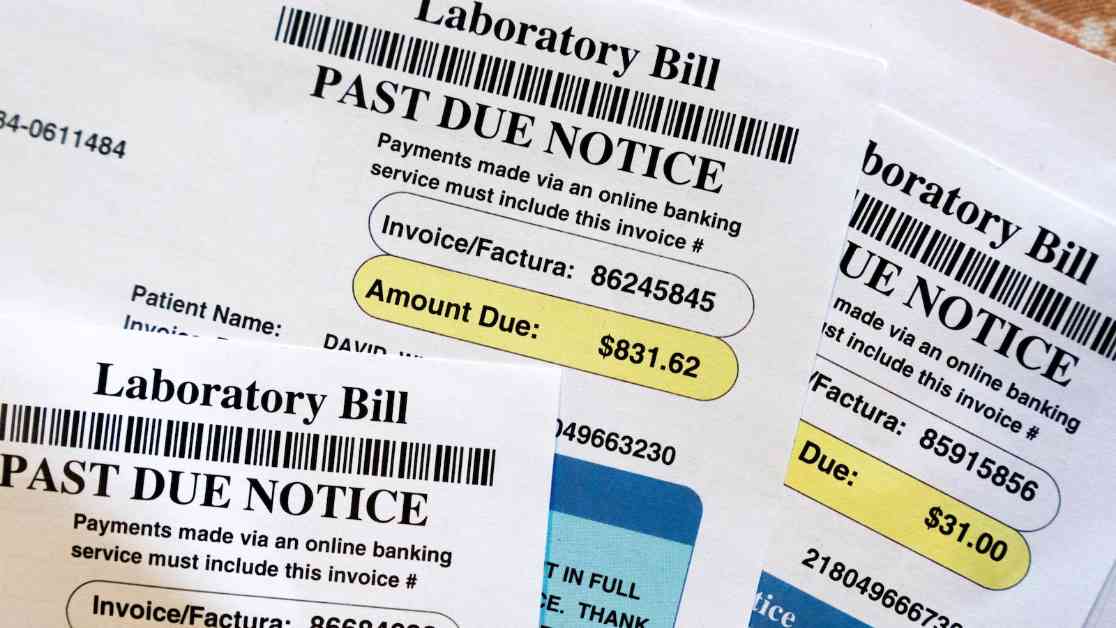

Unexpectedly high medical bills are a common issue in the United States, affecting one in five Americans with outstanding medical debt totaling $88 billion. A recent study found that 20% of U.S. households have medical debt, with 43 million credit reports showing collections from medical bills. In the second quarter of 2021, 58% of all bills in collections on credit records were medical bills. Medical debt disproportionately impacts Black and Hispanic individuals compared to white and Asian individuals, and it is more prevalent in the Southern U.S. due to limited Medicaid coverage expansion.

Navigating the process of dealing with high medical bills can be daunting, but patients should not be discouraged. If you find yourself facing unexpectedly high medical bills, there are steps you can take to alleviate the financial burden. For example, Luisa, a 33-year-old who received a $1,000 medical bill after an emergency hospital visit, was able to have the entire amount covered by the hospital through their financial assistance policy. By reaching out to patient advocacy organizations like Dollar For, individuals can explore options for financial assistance and potentially have their bills reduced or waived.

Nonprofit hospitals are required by law to offer charity care programs that can lower or write off bills for individuals based on their household income. Patients can determine if they qualify for financial assistance by searching online for the hospital’s charity care or financial assistance policy. Additionally, the federal No Surprises Act provides protections against surprise medical bills for individuals with private insurance, ensuring coverage for out-of-network services related to emergency and some non-emergency care.

When dealing with medical bills, it’s essential to scrutinize the charges for accuracy and potential errors. Requesting an itemized bill with billing codes can help identify discrepancies, which can be contested with the healthcare provider or insurance company. Comparing the billing codes with insurance estimates and the explanation of benefits can also reveal overcharges or inconsistencies that can be addressed to lower costs. Patients should be proactive in appealing health claims with their insurance company if they believe the bills should be covered more than initially decided.

By being informed and proactive in managing medical bills, individuals can navigate the complex healthcare system and potentially reduce their financial burden. Seeking assistance from patient advocacy organizations, understanding available protections under the law, and scrutinizing billing details can help individuals facing unexpectedly high medical bills find relief and avoid unnecessary financial strain.